Italy growth to slow further in 2013

ROME- Italy’s real GDP growth is to fall further in 2013, the OECD has forecast. The Organisation for Economic Cooperation and Development (OECD) publishes an Economic Outlook biannually, with data forecasting gross domestic product (GDP) growth of its member countries.

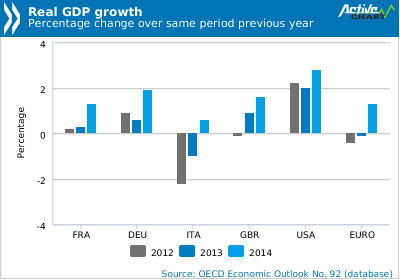

Italy’s GDP dropped by 2.2 percent in 2012, and is set to drop by another one percent next year. This is considerably lower than the Euro area average of 0.4 and 0.1 percent respectively. Italian growth is set to rise again in 2014, by 0.6 percent, though forecasts are liable to change depending on economic policies.

“The [Italian] economy is projected to continue contracting in the short term, reflecting budgetary tightening, weak confidence and tight credit supply,” the report says. Employment, wages and consumer prices will continue to suffer over the next few months, with the economy set to return to growth during 2013.

The figures published come from data from the past years as well as forecasts based on announced economic policies by national governments, and depend on the latter being followed through for accuracy. “The reforms of the product and labour markets which parliament has adopted over the past twelve months are impressive but must be fully and consistently implemented if they are to produce results,” it says of Italy.

Unemployment is forecast to continue to rise in the next two years, by 0.7 percent in 2013 and a further 0.4 percent in 2014, to reach a total rate of 11.8 percent in 2014, compared to the 2012 rate of 10.6 percent. The report says Italian employment is “robust”, as the rising unemployment figure is partly due to higher participation. The slow wage growth and slowing consumer price inflation will eventually boost exports.

The UK sees its GDP forecast to rise by 0.9 percent in 2013 and 1.6 percent in 2014, while the USA’s growth should go up by 2.0 and 2.8 percent respectively.

“The world economy is far from being out of the woods,” OECD Secretary-General Angel Gurría said during the Economic Outlook launch in Paris. “The US ‘fiscal cliff’, if it materialises, could tip an already weak economy into recession, while failure to solve the euro area crisis could lead to a major financial shock and global downturn. Governments must act decisively, using all the tools at their disposal to turn confidence around and boost growth and jobs, in the United States, in Europe, and elsewhere,” Mr Gurría said.

*Data and quotes sourced from OECD Economic Outlook, Vol. 2012/2.